BBBank: Implementation and Realization of Process Automation

Technical setup of the RPA infrastructure, bot development as well as training and support for the BBBank team to optimize service quality.

The Key Facts at a Glance:

- Automation rates of up to 100%

- Increased process efficiency

- Extension of service times

The Challenge

With almost 500,000 members, BBBank is one of the largest cooperative banks in Germany. Founded in 1921, it serves as the bank for private customers and the public sector in Germany. Operating under the motto »Better Banking«, the company prioritizes its customers. Through its integrated direct bank »BBDirekt«, mobile banking services, and nationwide branch network, BBBank combines personal customer proximity with accessibility.

The time required for this classification can vary depending on the volume of ticket content, taking several minutes. In total, this task can consume hundreds or thousands of working hours annually.

Almato supports BBBank in implementing and realizing process automation with software robots. The aim of utilizing RPA is to decrease manual data entry tasks and enhance service levels, particularly in customer service, focusing on response and service times.

The Almato Solution

Automated processes (excerpt)

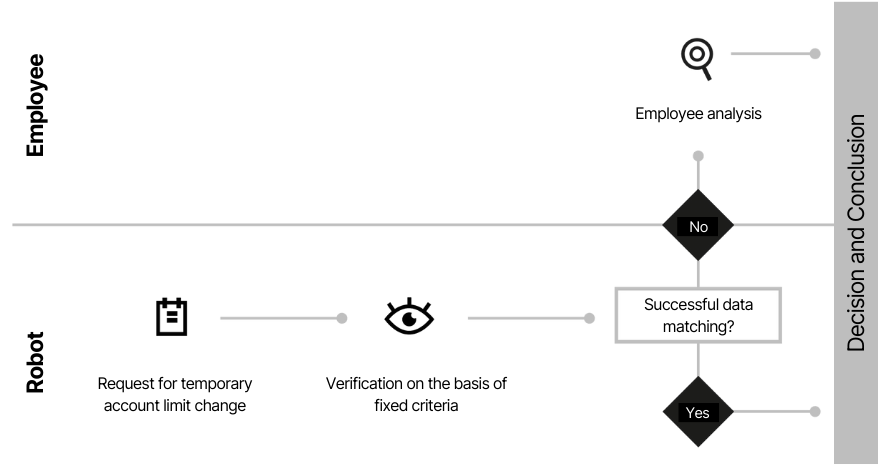

- Changing the Online Transfer Limit: Automated processing of customer requests to (temporarily) modify the transfer limit through BBBank's online service.

- BBBank VR-Net Key: Automated processing of SecureGo orders (TAN app) and SmartTan for online banking.

- Collateral Management in accordance with CRR: Updating credit balance values for third-party collateral.

- Consumer Loans: Processing redemptions and portfolio changes for customer loans using software robots. This includes form extraction, account creation following plausibility checks, generating payment plan records for internal and external redemptions, and executing loan repayments as well as the deletion or reduction of credit limits.

- Reward Distribution: Automatic processing of reward bookings as part of customer referral programs.

Process example: Temporary account limit change

The Success

With Robotic Process Automation from Almato, BBBank's customer service can now also be offered outside of employees' working hours, for example in the evenings and at weekends. In addition, time-critical processes can be implemented independently of employee availability.

»As a rule, requests are processed on a case-by-case basis - in other words, the automation rate of processes processed via RPA is close to 100 percent.«

– Stefan Welte, Project Manager, BBBank eG